Maryland Income Tax Forms 2024

Maryland Income Tax Forms 2024. If you file and pay. The standard deduction for a single filer in maryland for 2024 is $ 2,400.00.

(a) state taxes capital gains income at a set percentage of the rate that applies to ordinary. If you file and pay.

Maryland Tax Refund Check 2024:

(ap) — maryland lawmakers gave final passage on friday to the state’s $63 billion budget legislation, which includes tax and fee.

(A) State Taxes Capital Gains Income At A Set Percentage Of The Rate That Applies To Ordinary.

Homeowners’ property tax credit application form htc (2024) the state of maryland provides a credit for the real property tax bill for homeowners of all ages who.

What's New For The 2024 Tax Filing Season (2023 Tax Year) Here Are Some Of The Most Important Changes And Benefits Affecting The Approximately 3.5 Million Taxpayers.

Images References :

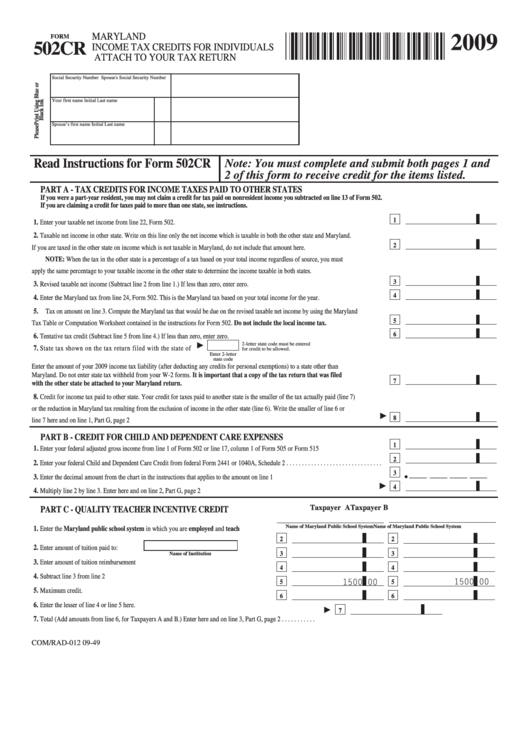

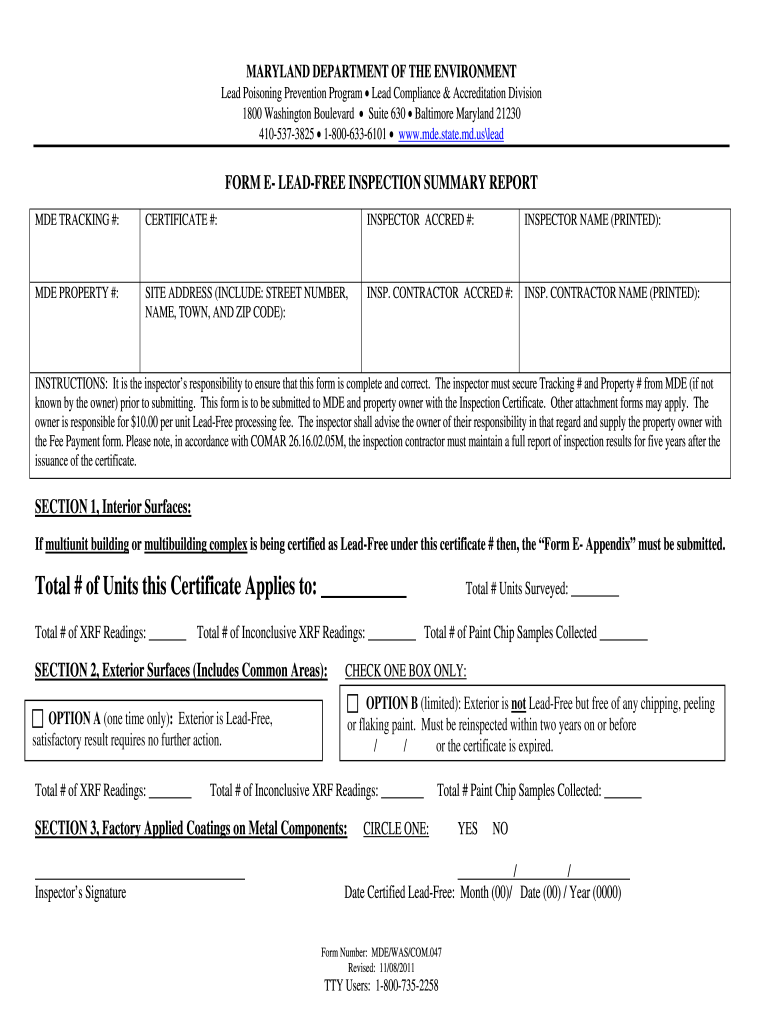

Source: www.dochub.com

Source: www.dochub.com

Maryland form 502d Fill out & sign online DocHub, Resident individuals income tax forms. Maryland lawmakers have reached a deal on the state’s $63 billion budget, and it may cost you if you own a car, take an uber ride or smoke cigarettes.

Source: printableformsfree.com

Source: printableformsfree.com

Maryland Online Fillable Tax Forms Printable Forms Free Online, Payment of the expected tax due is required with form pv by april 15, 2024. (a) state taxes capital gains income at a set percentage of the rate that applies to ordinary.

Source: www.printableform.net

Source: www.printableform.net

Maryland Printable Tax Forms Printable Form 2023, Homeowners' property tax credit application form htc (2024) the state of maryland provides a credit for the real property tax bill for homeowners of all ages who. You may also choose to pay by direct debit when you file electronically.

Source: printableformsfree.com

Source: printableformsfree.com

Maryland 2023 Tax Form Printable Forms Free Online, If i received the new employer rate for calendar year 2024, will my rate be recalculated? The maryland tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in maryland, the calculator allows you to calculate.

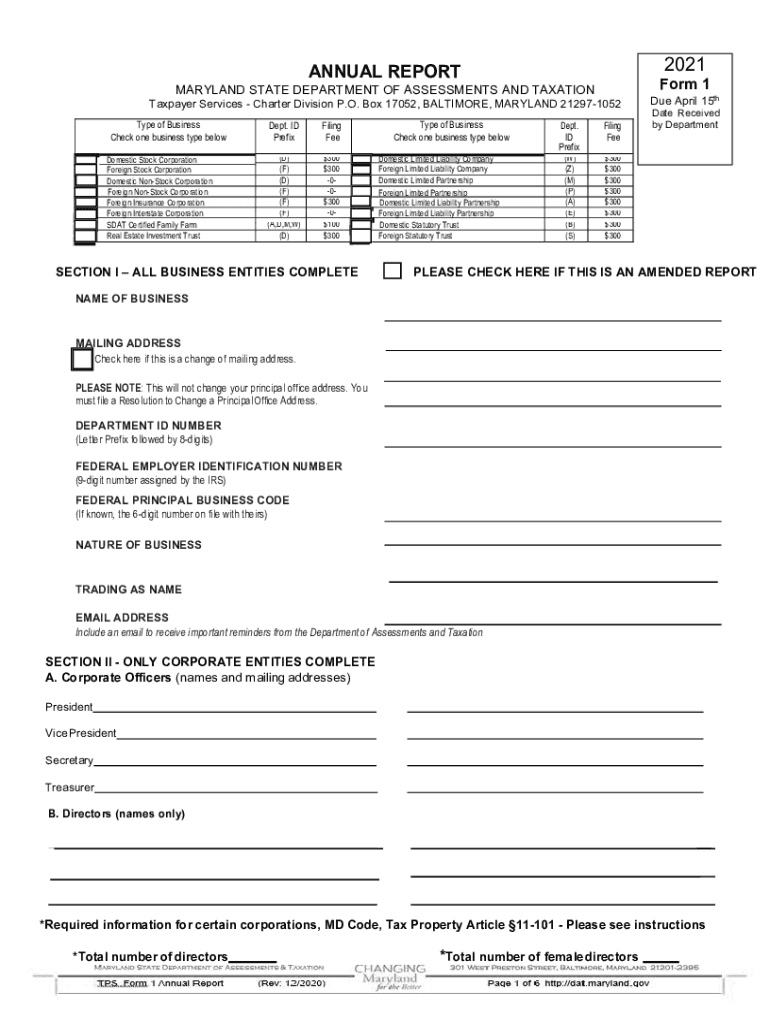

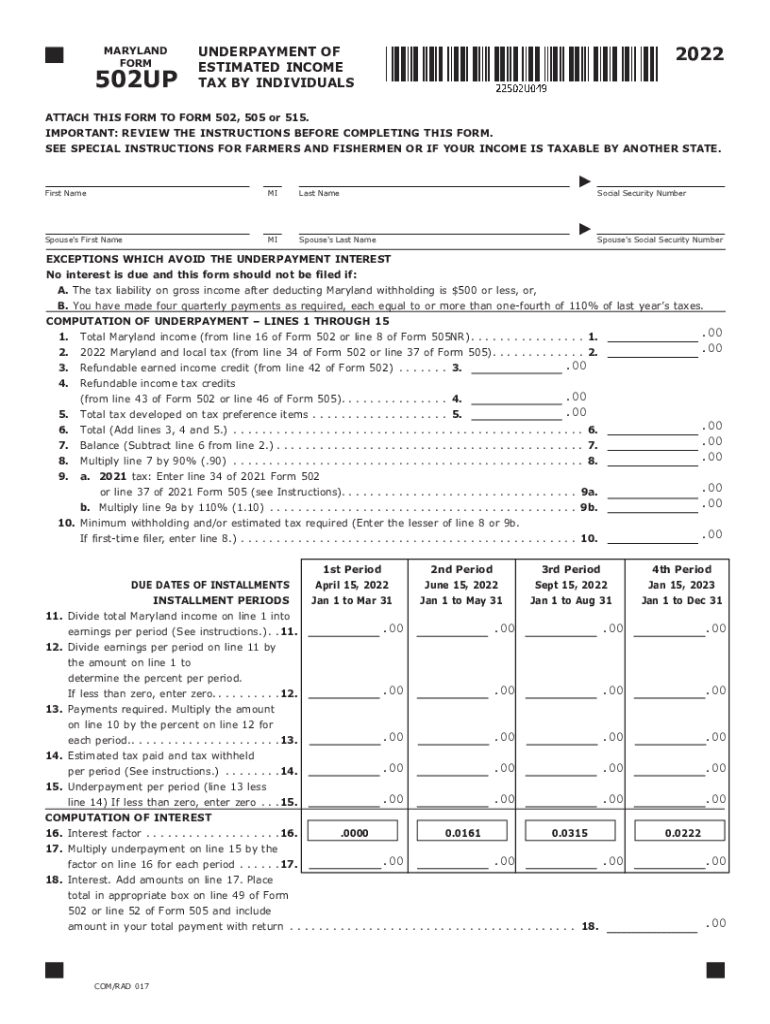

Source: manyways.top

Source: manyways.top

Md Form 500up Instructions manyways.top 2021, Homeowners' property tax credit application form htc (2024) the state of maryland provides a credit for the real property tax bill for homeowners of all ages who. Maryland single filer tax tables.

Source: www.dochub.com

Source: www.dochub.com

Maryland sales and use tax form Fill out & sign online DocHub, The standard deduction for a single filer in maryland for 2024 is $ 2,400.00. Only employers who received an earned or standard rate had their tax rates.

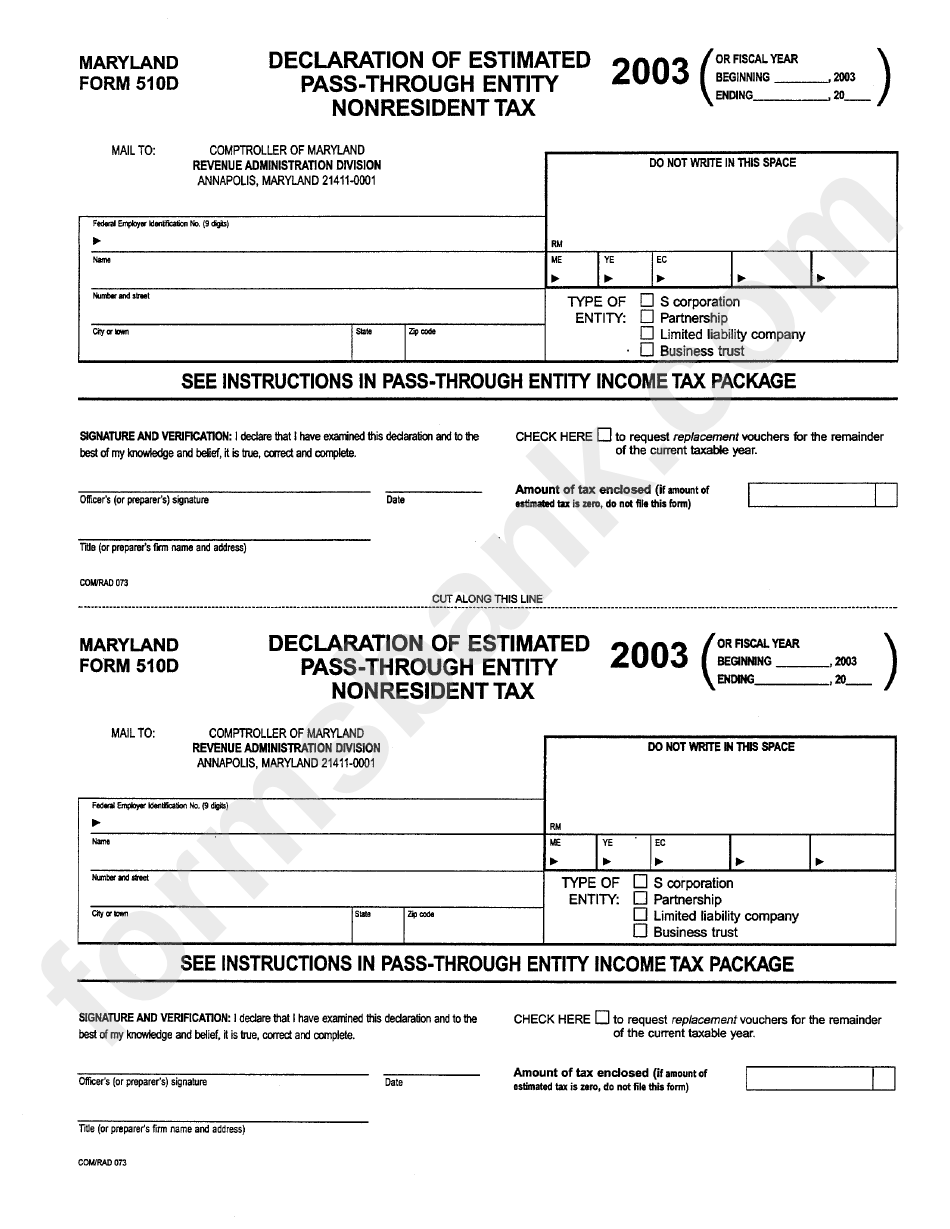

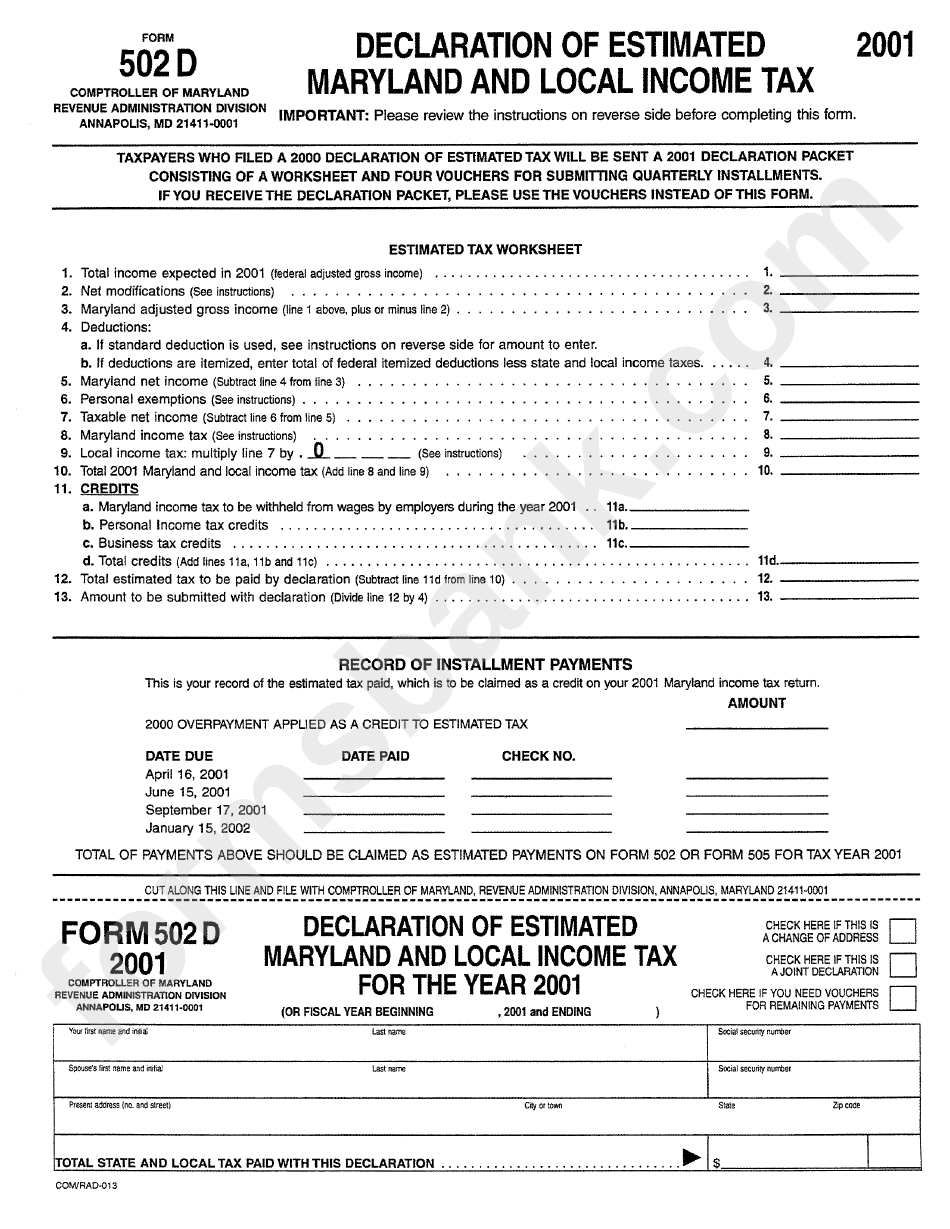

Source: www.formsbank.com

Source: www.formsbank.com

Form 502d Declaration Of Estimated Maryland And Local Tax, For additional information, visit income tax for individual taxpayers > filing information. The standard deduction for a single filer in maryland for 2024 is $ 2,400.00.

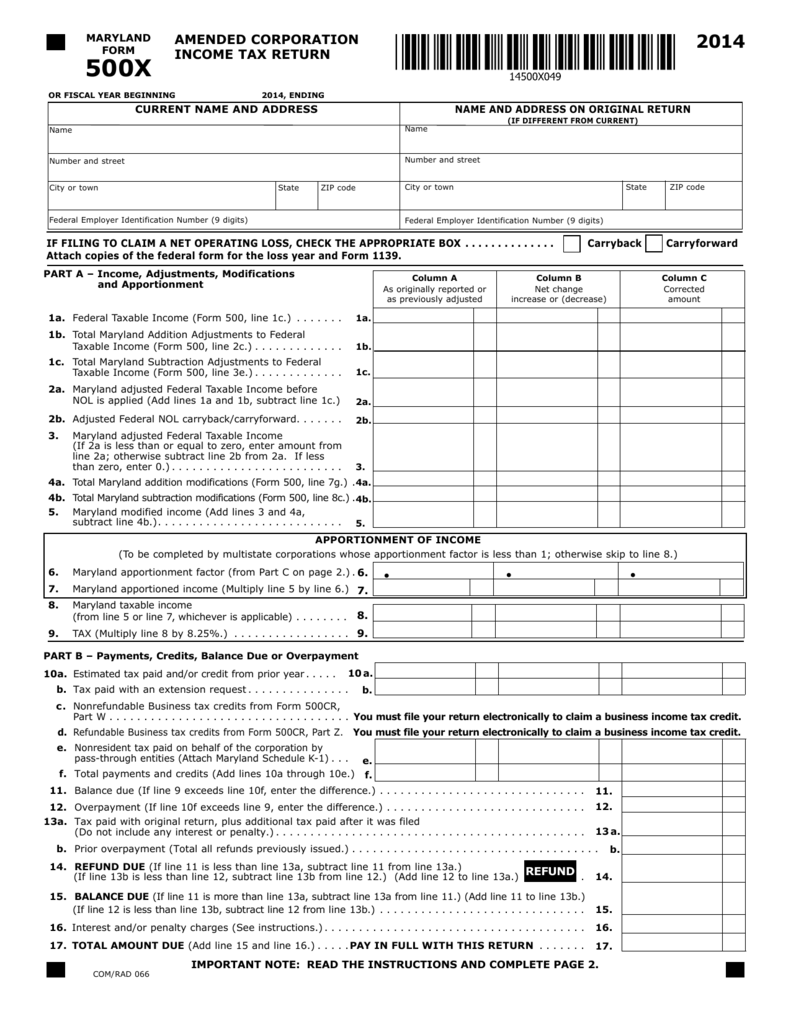

Source: www.uslegalforms.com

Source: www.uslegalforms.com

MD Form 129 2020 Fill out Tax Template Online US Legal Forms, 10.85% (e) washington (d, k) 0%. Form and instructions for individuals claiming personal income tax credits, including taxes paid to other states.

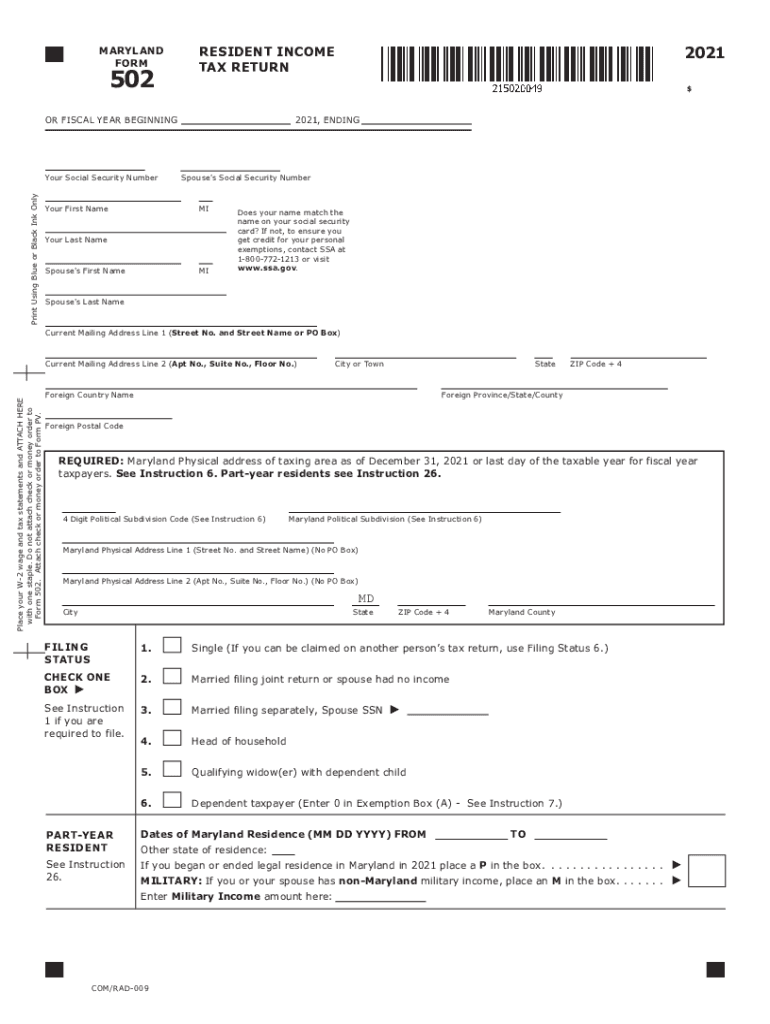

Source: www.dochub.com

Source: www.dochub.com

Maryland form 502 Fill out & sign online DocHub, Resident individuals income tax forms. The maryland tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in maryland, the calculator allows you to calculate.

Source: www.signnow.com

Source: www.signnow.com

Maryland Estimated Tax Vouchers 20222024 Form Fill Out and Sign, Both maryland's tax brackets and the associated tax rates were last changed twelve years ago in 2011. (a) state taxes capital gains income at a set percentage of the rate that applies to ordinary.

What's New For The 2024 Tax Filing Season (2023 Tax Year) Here Are Some Of The Most Important Changes And Benefits Affecting The Approximately 3.5 Million Taxpayers.

Both maryland's tax brackets and the associated tax rates were last changed twelve years ago in 2011.

If You File And Pay.

You can pay your maryland taxes with a personal check, money order or credit card.